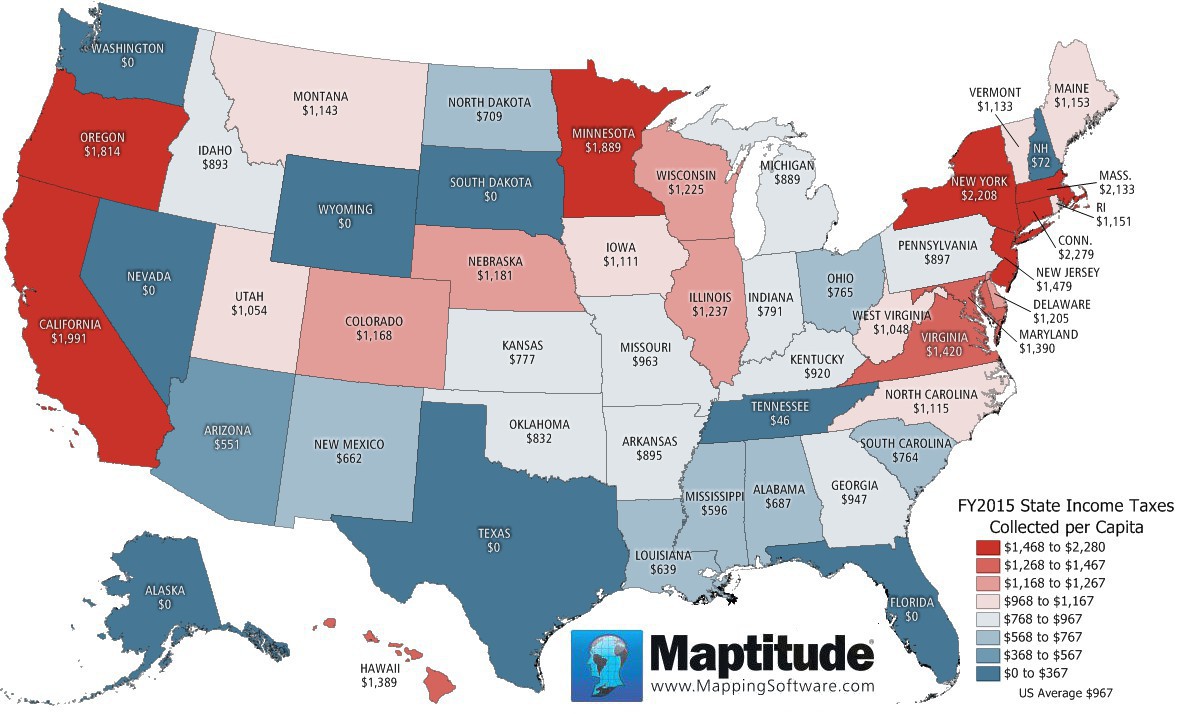

per capita tax burden by state

The reason that Washington ranks higher in per capita taxes than for taxes in relationship to personal income is that Washington enjoys relative high per capita personal income see Table 5. State and Local Issues.

Which States Pay The Most Federal Taxes Moneyrates

The statistic above provides information on the state and local tax burden per capita in the United States in fiscal year 2011.

. Tax Burden State By State Our ranking of Best And Worst States for Taxes captures the total tax burden per capita not only for income property and. However residents of each of the top 10 states pay 3-5 times as much in federal taxes as residents of Mississippi. Sales and gross receipt taxes.

Chart 2 portrays the change in per capita state and local taxes since 1970 for Washington and the average for all states. 50 rows We share the overall tax burden by state for an average household to help decide where to. A per capita tax comparison is far from complete however because differences in the level of.

Delaware follows with 552 and the second-lowest sales and excise tax rate of 120. In the fiscal year of. Despite its high tax burden todays report showed New York ranked far down among the list of states in per capita expenditure by state and local governments on.

State and Local Tax Revenue Per Capita. Washingtons average tax burden is more than 400 per 1000 below the national average. Using the full income tax parameters for all US.

Alaska is one of seven states with no state income tax. State and Local General Expenditures Per Capita. When breaking down tax burdens by category New Hampshire has the highest property tax burden in the nation at 557.

State and Local Issues. Walt Disney Worlds Magic Kingdom November 11 2001 in Orlando Florida. Finally New York Illinois and Connecticut are the states with the highest tax burden for the middle 60 by family income.

This table includes the per capita tax collected at the state level. The average resident of a blue state pays 9438 in federal taxes while the average resident of a red state pays 6591. States use a different combination of sales income excise taxes and user feesSome are levied directly from residents and others are levied indirectly.

State tax levels indicate both the tax burden and the services a state can afford to provide residents. The amount of federal taxes paid minus federal spending received per person by state can be found here. State and local tax burdens of about 115 per 1000 of personal income were typical for Washington and the state usually.

The state with the lowest tax burden is Alaska at 516. 47 rows New York and Connecticut have the highest state tax burden state and local tax burden. The jurisdictions with the lowest overall tax rate by state for the top earners are Nevada 19 Florida 23 and Alaska 25.

The effective tax burdens in these states are 125 122 and 116. Total taxes per capita. In the nation and 10th among the 13 western states.

States from 19772002 I create a simulated tax redistribution index that captures the mechanical impact of changes in tax policy on the Gini coefficient but is exogenous to any behavioral response.

Best States To Retired In With The Lowest Cost Of Living Finance 101 Gas Tax Healthcare Costs Better Healthcare

Individual Income Tax Collections Per Capita Tax Foundation

2016 Property Taxes Per Capita State And Local Property Tax Home Buying Buying A New Home

Which States Are Givers And Which Are Takers The Atlantic

U S Cigarette Consumption Pack Sales Per Capita Vivid Maps

Here Are The Most Tax Friendly States For Retirees

How High Are Capital Gains Tax Rates In Your State Capital Gains Tax Capital Gain Finance Jobs

Who Pays And Who Receives In Confederation Finances Of The Nation

Monday Map State Local Property Tax Collections Per Capita Tax Foundation

Tax Burden By State 2022 State And Local Taxes Tax Foundation

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

States With The Highest And Lowest Property Taxes Property Tax Tax States

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax Tax State Tax

Maptitude Map Per Capita State Income Taxes

/media/img/posts/2014/05/ACS_2012_5yr_Income_in_2012_below_poverty_level/original.png)